Jason Flaxbeard, of Beecher Carlson, discusses a possible future of insurance from a captive perspective and how companies can use existing vehicles more efficiently.

New capital is changing the way insurance transactions take place. Insurance buyers and risk takers are becoming more sophisticated. Today, buying insurance is an inexact science. Or maybe it is art. This mix of art and science in the placement process leads to market inefficiencies.

The insurance industry’s “cost of goods sold” isn’t a concrete measure, and this is likely to continue. This paper will take a look at the buying process and the cost of capital inefficiencies that are currently being leveraged by companies that have access to large amounts of data, robust balance sheets and a positive attitude towards risk assumption.

Market (in)efficiencies

If we take the position that the most efficient way to write insurance is to match risk takers with risk buyers, we find an efficient intermediary/broker. Capital moves and capital providers’ appetites change. Thus, a broker’s job is to find the most cost effective capital for a client. Traditionally, this capital has existed at insurance companies, but a capital influx into the reinsurance industry has provided these insurance companies with vehicles through which risk can be laid off in a cost-effective manner.

Insurance companies serve as aggregators of risk, and they provide access to risk purchasers in a heavily regulated environment. And that’s what all capital wants – access to risk buyers. Capital providers don’t want to reinsure insurance companies necessarily because, by the time the risk premium arrives in their income statement, it has been netted down for brokerage commission, insurance company overhead and profit and other frictional costs.

Another cause of market inefficiency is the information asymmetry between insurance buyer and capital. This is most visible through “per account underwriting” from underwriters. Such discrete processes represent an insurer’s defense mechanism against the adverse effects of the information gap, and this prevents the market from becoming more liquid and efficient.

Corporate (in)efficiencies

Many companies buy discrete lines of insurance coverage. The methodology behind these purchasing decisions, if not driven by statutory requirements (workers’ compensation for instance), appears inexact. Chief financial officers, treasurers and risk managers are all looking for ways to map overall corporate risk.

Access to increased data is allowing them to do so. Their focus now is on risk tolerance, risk appetite and the supporting data. After determining how much risk to take on (this may be an earnings per share discussion or a balance sheet/cash-flow calculation), the question becomes how to finance that risk.

Creating a loss curve for each line of business is vitally important. The tolerance and appetite discussion with a CFO, however, is not usually based around a discrete line of business. A CFO wants to know an overall corporate risk profile.

Risk aggregation and susceptibility to shocks throughout a company are more important to a CFO than, say, losses on an auto line of business. The CFO and board try to protect against losses that offer material downside risk to the company. This downside risk is calculated using aggregated rather than discrete loss curves.

If one asks a risk manager to identify the worst case loss scenario across any and all lines of business, the answer that comes back is usually based on a specific line of business. But that loss can typically lead to other losses. Most entities fear multiple losses across several lines rather than individual losses. Mapping can be used to develop aggregated loss curves using discrete line loss curves following a correlation analysis between these lines.

The correlation analysis is often enlightening. For example, buying three towers of insurance each with a limit of $1bn offers a company protection of $3bn. The correlation analysis across these three lines of business will look at the possibility of the three lines being exhausted in the same year. This outcome is unlikely.

The correlation analysis may also show that the Value-at-Risk (VaR) for each line is $20m, totalling $60m when added together. But on a correlated basis, the overall VaR across all lines, given portfolio theory, may be closer to $40m. This is a crude example, but experience bears this out.

What needs to be insured in an efficient manner is a company’s VaR at the $40m level coupled with an excess position based on the aggregated risk curve rather than discrete line risk curves. Risk managers that buy insurance on a line by line basis may be buying too much insurance.

Broker (in)efficiency

So it appears that the insurance market is inefficient and companies are buying too much insurance. This is why the market is awash with capital.

Captives offer a solution. Captives can provide companies with access to capital through reinsurance, cutting through the insurance buying process. They can be structured to write all corporate risk in a manner where the company retains an aggregated amount of risk, purchasing an integrated stop loss product at the point where the curve becomes steepest. Finding the efficient frontier for insurance purchase is where art and science intersect.

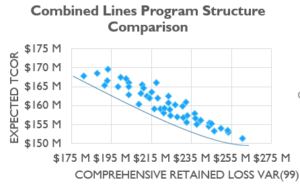

Diagram 2 shows a myriad of differing costs of insurance products. In this example, the total cost of risk (TCOR) is shown on the Y axis and the comprehensive retained loss is shown on the X axis. The line among the options is the efficient frontier line. Points on the graph that are on this frontier show an efficient buying decision. These points indicate where the cost of purchasing insurance in the marketplace is minimised for a given amount of corporate loss volatility off-loaded in the transfer.

Consequently, companies looking to purchase insurance on an integrated basis are always looking for these points. There are many ways to purchase insurance inefficiently, and these often involve overpaying for unneeded capital or capital whose access cost is more expensive than retained capital. With the work of the actuaries complete following a marketing exercise by a broker, the curve above can be used to define the right product to engage.

Large companies and large swathes of reinsurance based capital are looking for this chain to collapse sooner rather than later. Reinsurance companies and other unencumbered capital sources are challenged by statutory regulation for workers’ compensation and other lines of business, risk management consultants and a lack of access to clients – the risk buyers.

As the value chain collapses, the role of the risk management consultant or broker also changes. The broker of the future, at least on large accounts, are risk modelling consultants, captive specialists, market brokers (at the right time) and finance executives in one. A risk taking captive will annually review its profile and review the cost of its capital against the availability of cheaper capital.

This changed position for risk consultants looks at risk in the following way:

MUCH LESS RISK TRANSFER TO BE PURCHASED

- Define spend on risk transfer premiums/fees

- US WC/AL could be the only risk transfer purchased by line, subject to reinsurance appetite; having catastrophic nature, consider transferring some property

- Consider the extensive use of a captive to aggregate risk

BROKERAGE PARTNER’s ROLE AS FOLLOWS

- Identify/procure all of the risk mitigation and claims management services that the captive may need

- Stay on the cutting edge of risk identification and quantification

- Access risk capital to cap aggregate losses for the captive

- Manage the worldwide fronting and risk management service needs for operations

Conclusion

Many large companies make risk purchasing decisions to protect themselves from catastrophic risk such as hurricanes for heavy property risks, auto liability for trucking risks or medical malpractice for healthcare risks.

Assessing that risk alone without assessing corporate insurable risk as a whole may lead to inefficient buying decisions. As data availability, quality and analytics continue to develop, the buying decision around insurance will change.

Companies will become less emotional around risk retention. They will take longer term views of risk reward, and they will trend towards efficient usage of capital – whether that be internally or externally sourced.

But that’s not the end of it. Capital is fleeting. Maintaining a vehicle that allows capital sources to access risk without erosion from the value chain will become vitally important for companies. Reinsurance companies want access to risk premium before it has been diluted by administrative costs.

A captive’s role will be the support of the process to match these two key components of the value chain together. And the day will come when a capital source will not necessarily be a large entity.

I can foresee investing in a corporate captive whose risk is sold on the open market. But that’s five to 10 years from now. Or is it two? Or is it closer? It depends on the artist.

Biography

Jason manages the Beecher Carlson alternative risk operations within the US, Bermuda and Cayman Islands. Beecher Carlson manages complex risk strategies for some of the world’s largest companies. Flaxbeard has over 20 years of experience in the captive insurance industry and has been with Beecher Carlson since 2001. He manages the captive operations from Denver. He is a graduate of Bath University, England, an English Chartered Accountant and a Chartered Property and Casualty Underwriter.