Tatjana Winter, of Ryskex, reflects on the rise of blockchain, its utility for the captive industry, and where the technology may be headed.

Tatjana Winter (MBA) is head of research @ Block-ART Institute and a PhD student in the field of platform and ecosystem solutions in the risk and insurance industry. She can be contacted at: winter@ryskex.com

Risk and insurance managers need to investigate and analyse technological changes and the latest developments on the market. These in turn lead to a constant flow of new buzzwords that dominate press coverage and penetrate the jargon used by c-suite members and research institutions alike.

One of the latest is “blockchain”. Is this technology just a trend or a real gamechanger? What sets this technology apart? Is it really disruptive or just a short-lived trend? If this is Internet 2.0, how will blockchain affect the insurance market in general and the captives market in particular?

The following article presents the technology and its added value, brings it into line with changes in the risk portfolio and gives an overview of prevailing developments of well-known market participants.

Blockchain technology and its benefits

Technology journalist Chris Dannen described blockchain in 2017 as follows: “Blockchain is a fully distributed, peer-topeer software network which makes use of cryptography to securely host applications, store data, and easily transfer digital instruments of value.”

Blockchains can be used anywhere information needs to be securely managed and verifi ed. The technologyis based on a decentralised opensource network driven by all the network participants and consistently, verifiably, efficiently, and unambiguously documents transactions on a continuous basis using signatures.

The open-source aspect and the integrated redundancies based on the number of participants in the block protect the data against manipulation and deletion. This allows transactions, digital goods, values, processes, and tasks to be identified, validated and exchanged.

The disruptive potential is created by the secure management and verification of information and values, which allows users to circumvent the trustworthy intermediaries previously required for such tasks.

The roles previously assumed mostly by financial and insurance service providers could now potentially be usurped. With peer-to-peer communication, the parties no longer have to depend on reputations of trust because the information is unambiguous and fully retroactively visible.

The blockchain describes a publicly accessible ‘cash ledger’, which cannot be edited retrospectively.

Data (for example, transaction data) is entered into the ledger in the form of blocks. Data is collected over a certain timeframe, added to a block and then checked for validity. Proof-of-work requires a resource-intensive computing task, which can be solved by several attempts.

A fraud attempt becomes economically unattractive due to the required resources. The technical prerequisites for a fraud attempt currently do not exist – it is technically hugely difficult to impossible.

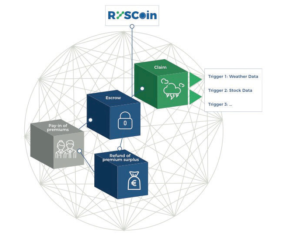

With proof-of-stake, it is the respective technology concept’s stakes that are decisive, independent of the use of resources. These can be tokens of the respective blockchain technology such as BIT – or RYSCoins but they do not have to be a cryptocurrency.

This can also be the transfer of ‘risks’ – which is in turn the basis for hedging solutions such as insurances. The benefits of blockchain technology can be summarised as follows:

– Decentralised consensus formation without intermediaries (e.g. re/insurance brokers or insurance companies themselves). The trust is placed in the network and the blockchain technology

– Lower costs for operators will also have a positive effect on the transaction fees and reduces administrative costs

– Transparent costs and the further development of the technology through open source code, coordinated via “consensus mechanisms”

– Highly redundant and fail-safe

– High network and process transparency while preserving anonymity and pseudonymity of the participant. This reduces imbalances in power, abuses and arbitrary decisions

– Cost-efficiency, transparency, safety

VUCA world and its influences on the risk and captive management

Today’s global companies are forced to deal with a variety of risks. In addition to disaster risks, property risks, liability risks, financial risks, personnel risks, market risks, a stronger emphasis is being placed on newer risks, such as terrorist attacks, and risks that arise due to digitisation.

These circumstances require companies to use holistic risk management in order to keep the impact on the company and the business environment as low as possible in the event that such risks materialise.

Since the economy is now globally connected, the total failure of a company may have a ‘butterfly

effect’ that results in extensive damage to the overall economy. Accordingly, there are various frameworks that the management boards of companies can use to ensure that management can adequately deal with risk.

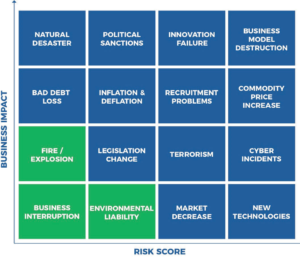

Empirical values and experience ensure that traditional risks such as fire or business interruption are no longer existence-threatening for the company, but the threatening risks are innovating (see Rysk Map).

Correspondingly, it is necessary to meet them with innovative solutions such as contemporary legislations and modern hedging tools. Not all risks are transferred to an insurer, even if the companies would like them to be insurers do not assume all risks, and many are thus uninsurable, or insurable only to a limited extent.

An example can be taken from a volcanic eruption in Iceland: The multiweek closure of European airspace and the losses suffered in the aviation industry were not covered by insurance.

Uninsurable risks can pose a significant threat to the future of a company. Companies face a risk landscape that has in part been reconstituted in recent years.

Not only have recent years seen structural changes in the economy, but there have also been notable changes in the legal environment and new forms of risk stemming from digitisation and globalisation, including global political changes and technological innovations.

The complexity of these changes has led to a permanent extension of the limits of insurability and ultimately the need to design new insurance products.

As the current Allianz Risk Barometer, AON Risk Management Report or the BlockART Institute RYSK MAP show, corporate risk managers have an increasingly changed perception of existence-threatening risks.

Global developments, such as digital and physical technologies (such as additive manufacturing), nanotechnology, driverless vehicles, and smart cities and factories create a new standard, bring positive aspects and boost the economy, but this is accompanied by a great deal of uncertainty and the risk that the company’s business model is in question or even rationalised.

Especially in the automotive sector an unprecedented change is taking place. Electric cars of the future will be self-driving, and an important aspect for successful sales is interpreted as the entertainment system of the vehicle.

This goes hand in hand with production becoming increasingly more digital (the Internet of

Things) and suppliers of the required parts will change as a whole. At the same time Amazon represents the supermarket of the future as it exits from the digital world into the stationary.

The fashion industry is equally undergoing a transformation and is continuously individualised and greener. Fairtrade is increasingly becoming the focus of the buyer – Adidas has had an initial success with collections made from ocean garbage, which is processed by means of additive manufacturing for individualised and ecologically acceptable garments to suit the lifestyle of the health and sustainability community.

Companies are responding to the growing trend of greening and are expanding their product portfolios towards vegan and vegetarian, so as not to leave this market completely closed to new entrants.

These developments affect the captive market and its managers directly and indirectly. On the one hand, captive owners need new concepts and insurance lines for the extended risk portfolio, on the other hand they are subject to cost pressure and are required to keep pace with prevailing technological developments.

Ideally, captives are independent profit centres and efficiency-enhancing measures have a direct impact on the value of the company as a whole. Accordingly, it seems necessary for decision-makers to deal with technological possibilities such as blockchain technology.

The challenges that arise for the insurance market in general and the captive market in particular can be summarised as follows:

– high administrative and regulatory costs,

– lack of capacity for insurable and non-insurable risks,

– insufficient solution concepts for existence-threatening risks,

– sufficient capitalisation for risk investments,

– and insufficient use of digitisation.

The risk portfolios of companies have changed fundamentally due to developments in the last decades.

The insurance industry, on the other hand, has become more cumbersome and offers only rudimentary and expansive solutions, which do not fully satisfy customer needs.

New risk hedging concepts based on blockchain technology

Based on these findings, the statement of Walter Kielholz, acting chairman of Swiss Re, predicts a bleak future for current market participants and their business models.

According to him, technology will “completely disrupt the insurance industry”.

Paul Meeusen, head of distributed ledger technology of Swiss Re and member of B3i, takes a more positive view of the future.

He focuses on the added value of blockchain technology and sees it as an opportunity for the industry: “Blockchain holds promise for insurance by lowering costs. This technology is well suited to deal with key issues in insurance where some 50% of premiums are eventually used to pay for indemnity.”

McKinsey & Company already defines the potential for new concepts and resulting business models: “New ecosystems are likely to emerge in place of many traditional industries by 2025,” states the management consultancy in one of its research reports. Is the captive and insurance market one of these industries addressed?

“Considering the current market developments and the emerging INSURtech companies based on blockchain technology, the answer is yes,” states the CEO of RYSKEX GmbH, Marcus Schmalbach.

“The importance of blockchain technology is increasing from day to day because of our constantly changing world. Every development and decision is driven by the influences of a VUCA world, which lead to an evocative effect – the risks and especially the requirements for insurance

transforming.”

That the blockchain is a serious technology for the industry is underlined by the fact that not only startups deal with it, but also well-known, established companies – of the insurance and captive market – doing research in that field and developing business models.

For example, industry leaders such as AIG in cooperation with IBM are already giving some thought to this on a few projects.

They began collaborative work on “smart insurance policies” as far back as 2017. The core consideration here was that units from various countries could simultaneously access the master cover and the sub-policies in order to generate transparency and boost efficiency.

Another collaboration that attracted attention was led by the Danish shipping giant Maersk. In cooperation with EY and the data security firm Guardtime, they designed a blockchain-based marine insurance platform.

Great attention is also drawn to B3i conglomerate – which has leading insurers behind it. The plans do not seem to go beyond a beta version at the moment, but due to the participants involved, it can be stated that the insurance industry is seriously interested in this new technology and the possibilities associated with it.

In April, one of the world’s largest insurers caused a stir. Allianz announced that it is testing the introduction of its own ‘cryptocurrency’ in the form of an Allianz token. The intention is to increase efficiency while eliminating exchange rate risks in internal payment transactions.

Oliver Volk, a blockchain expert in Allianz’s reinsurance unit, confirmed that the token was in the works. Volk said in an interview with coindesk.com that an Allianz token would be “very helpful to get rid of FX constraints and other stuff we have to optimise, especially if you talk to certain currencies which we do not accept at our headquarters and have to be reconverted”.

He also said: “It would make sense to rely less on the banking system, as this would result in numerous savings on commissions and could be used by Allianz all over the world.”

Despite the projects presented, it can be rejoiced that research and development in the field of blockchain technology is still in its infancy in the captive industry.

This seems a bit contradictory as the parent companies of captives are often multi-billion corporates and characterised by innovative business models in their core markets.

Captive managers are predestined to play a pioneering role in the implementation of new technologies to create a blue print for the entire industrial insurance sector. The following conditions must be met:

– C-suite should think and act in a more innovative way

– Parent companies should provide sufficient capital for research and development

– There should be a willingness to open up to new developments and technological changes

– Cooperations with CAPtechs should be entered into

Conclusion and outlook

“To understand the future, we have to go back in time,” is a line of text from a soundtrack. The same applies to the possibilities offered by blockchain technology.

The origins of today’s industrial insurance and captive market can be found in 15th century London, when traders founded a Buyers Club to insure against the then-prevailing existence-threatening risks.

Fast-forward to the 21st century and the development of this Buyers Club has led to the billions of industrial insurance offers available on today’s market. This was an entire industry from the beginning, consisting of brokers, insurers, and reinsurers.

Combined with this are legal and tax parameters that make the market difficult for outsiders to understand, and make it seem very complex. Blockchain technology offers the platform for a new world order in the captive and industrial insurance market.

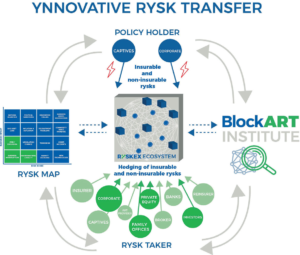

Ecosystems like RYSKEX can be the future. A solution concept for captive owners combining the simplicity during the covering and claim settlement process from the 15th century and the underwriting capacities and risk hedging portfolio required in 21st century.

The benefits of the RYSKEX ecosystem and its so called YNNOVATIVE RYSK TRANSFER:

– Efficency in cost and time

– Possibility of transfering non-insurable

risks

– Innovative form of investment

– Tax optimised investment model

– Cross deposite potentials for investors