The third quarter of 2014 has produced mixed results for the three featured investment indices. We ask London & Capital’s executive director Neil Michael to talk us through the performance.

Captive Review (CR): How and why have the three indices performed differently?

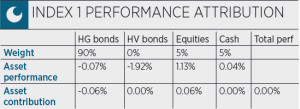

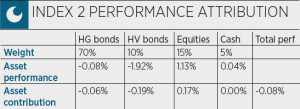

Neil Michael (NM): In the third quarter of 2014, Captive Index 1 was essentially flat, Captive Index 2 was fractionally down, and Captive Index 3 was slightly up in the quarter.

Strong economic data in the US sparked renewed speculation that the Federal Reserve might start to raise interest rates sooner than expected. This affected shorter dated high grade bonds in particular because they are more sensitive to expected policy change.

Since Captive Index 1 has a 90% exposure to shorter dated High Grade bonds, the performance of the Index was affected. Captive Index 2 also has some exposure to High Grade bonds but the maturity is not as low as in Index 1 and the overall exposure to bonds is lower.

Captive Index 3 produced the best return in the quarter because it has the highest exposure to equities which were the best performing asset class.

CR: What does this tell us about the indexes’ differing suitability for captive owners?

NM: One quarter is probably too short a period to judge the suitability of each Index for different captives. The year to date performance is probably a more appropriate time frame. Captive Indices 1, 2 and 3 have produced a return of 1.41%, 4.07% and 6.24%, respectively.

This indicates that the indices with the higher risk content produced the best returns, and this is what you would expect in the long run and is consistent with our historical analysis.

Captive Index 3, therefore, would have been suitable for a captive with a longer liability maturity profile, and Captive Index 1 would have been more suitable for captives with a shorter maturity profile. Even during the last quarter, which was a very challenging environment for short dated bonds, Captive Index 1 still managed to preserve capital.

CR: If you were running Index 2, should you be worried by the negative quarter or sit tight?

NM: Captive Index 2 is most appropriate for a captive with a mix of short- and long-term liabilities, and so their investment horizon would be in the middle of the range.

Consequently, they have the appetite to accept any short-term volatility in their investment portfolio. These captives will be able to benefit from the eventual rebound in risk asset (in this case high-yield bonds) as the natural state of these investments is to grow, in line with economic activity.

CR: What is the next quarter expected to bring for the three indexes? What are the economic trends to look out for in Q4?

NM: We expect equities, in the medium term, to continue to be supported by the beneficial effect of solid economic growth on company earnings, but, in the short term, to experience some volatility as QE comes to an end.

This is likely to help Captive Index 3 in the longer term but instil a degree of volatility in the immediate future. We expect some upward pressure on high-grade bond yields from a gradual elimination of economic slack and increasing focus on the first rate rise in 2015.

High-yield bonds may also get caught in the slipstream of a rise in short-term equity volatility, but will continue to benefit from a low default rate environment. As yields normalise, therefore, we expect Captive Indices 1 and 2 to do less well.