Captives as reinsurance companies play a central risk management role for large international operating companies. However, their use depends very much on the strategic risk management and risk financing priorities of the parent company.

Large international companies manage and finance their group retention centrally, while risks from the group’s subsidiaries are managed locally. Traditional approaches such as the introduction of deductibles with the ‘lead carrier’ attached to the master policy are only pursued by a few businesses. There is an increased market popularity of captives, which reinsure the risk exposure of its parent company and fellow subsidiaries in this challenging market environment.

Historically, we have experienced two related forces driving the emergence of captives. Firstly, the scarcity of insurance capacity forced corporations desperately seeking coverage to find and use alternative approaches. In many cases, businesses were not able to transfer risks to the market and therefore used captives to manage retained risks efficiently. Secondly, corporations that invested heavily in risk mitigation measures and, in return, had good loss experiences, found that over time, premium payments far exceeded claims payments. The parent company of a captive can effectively get a share of the underwriting profits of its insured business. As it participates directly in its loss experience, it has a strong incentive to further improve risk management and enhance risk awareness as well as loss prevention and control. Moreover, underwriting profits and investment returns traditionally reserved to the insurance industry can be retained within the group and improve its cashflow.

We have also observed that a captive self-retention within the primary layer of an international property programme provides financial incentives to influence future frequency claims through active risk management and the systematic identification, assessment and improvement of risks.

The access to the reinsurance markets through a captive can be an interesting opportunity for captive owners to navigate the hardening market.

In the context of international programmes, we have experienced over many years that captive owners use their reinsurance captives mostly to:

– optimise insurance and reinsurance structures

– benefit from arbitrage opportunities in the markets (pricing, coverage and capacity)

– strengthen the core business of the captive owner

– develop new solutions for new risks

– merge two worlds (life and non-life) into one reinsurance captive

The buying behaviour of captive owners have been observed at a portfolio level over many years. Generally speaking, Zurich’s international captive portfolio has shown a growing premium reinsurance share to 250 captives. The following discussion will provide a view whether captive owners have reacted to changing market requirements.

Hypothesis and how we tried to measure it

Captives present their owners with a powerful instrument enabling them to smoothen the impact of the insurance cycle and protect against fluctuation of asset values on the balance sheet.

- During a hard market, captive owners find that the price of risk is expensive and may therefore place an increased proportion in the captive. Captives therefore bear an increased burden and less risk is transferred to the traditional market.

- During a soft market, captive owners find that the cost of risk is relatively inexpensive and therefore tend to place an increased proportion on the traditional market. Captives bear less risk as more risk is transferred to the insurance and reinsurance markets.

Premiums in a hard market are generally at higher levels than the necessary premium required to finance the cost of claims via a captive, and lower in a soft market. Captive managers that actively manage their portfolio in accordance with market cycles could reduce the total premium necessary to finance to overall risk, compared to those that do not make adjustments.

While most people working in the insurance industry are well aware of the insurance cycle and knowledgeable about their ability to utilise their captive to juggle risk between the traditional and non-traditional markets, a long prevailing soft market has created a comfort zone which many are reluctant to leave.

The starting hypothesis for this analysis was that captive owners actively adjusted their portfolio to account for the insurance cycle.

The aim was to verify this hypothesis against actual observations from the Zurich portfolio. There were two challenges which immediately presented themselves:

- Captives can vary their risk exposure in numerous ways. For example, the captive coverage structure could be adjusted via individual risk limits or aggregate limits, subcovers could be adjusted, inclusions and exclusions are utilised to limit risk without impacting premium

- Insurance cycles are difficult to measure. The level of rate increase that corresponds to a hard market and the time period under consideration are not strictly defined. Furthermore, different lines of business experience insurance cycles to a variable degree

This analysis deals with the first challenge by considering the most prominent drivers used to adjust captive risk appetite, i.e., the primary components of the captive structure, the individual risk limit and the aggregate limit. The market survey discussed later in this article confirms that these levers were also the most commonly used in practice. Premium ceded to the captive was used as a further measure as a proxy for other adjustments.

To deal with the second challenge, a Zurich defined rate change was taken into account. Rate change is a measurement of how the premium of one year to the next would develop all else remaining equal, i.e., the underlying risk would not change. For example, a rate change of 5% would imply that the premium increased 5%, while there was no change to the underlying risk. The nature of commercial risk is that the underlying risk is constantly changing, new exposures are added, or businesses divested and the rate change considers how the premium would change if there was no change to the risk. Following that logic, it was possible to determine whether premium rates were hardening or softening, allowing for an evaluation of the insurance cycle.

Statistical results among our portfolio

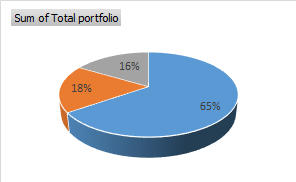

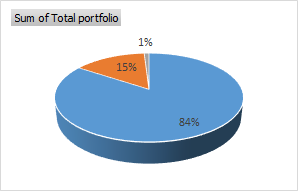

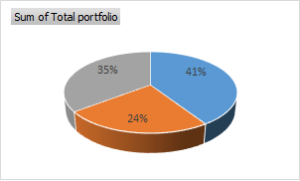

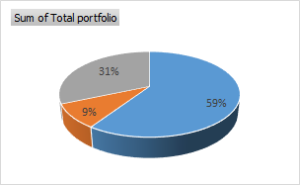

Using this analysis over the span of the last 10 years. For the view of the property portfolio, the blue areas of the pie chart Figures 1 & 2 highlight an increase in the corresponding indicators, the orange part a decrease and the grey part no change. The graphs for figures 1&2 show there was an overall positive rate change with 65% of the portfolio measured in premium volume seeing increased rates and a corresponding increase in premium ceded into captives. This indeed indicates a tendency of Captive owners to adjust their portfolios and thereby utilising their captives as rates have hardened. Similarly, it could be seen that a majority of customers increased their individual risk limits as well as aggregate limits indicating captives were assuming more risk as positive rate changes were applied. Figures 3 & 4

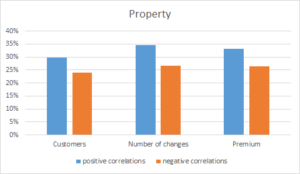

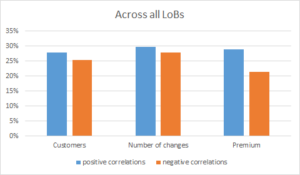

In a deeper analysis of statistics comparing ratios of positive and negative correlations, see for property, Figure 5 and Figure 6 for all LOBs. Three different ratios were considered over a ten year time period: customers, number of changes, premium.

In the first two ratios, positively correlated implied that an increase in the rate change would go hand-in-hand with an increase in the captive retention, i.e., the approach described in the last section for the hard market, and vice versa for a decrease in the rate change. On the other hand, negative correlated would correspond to the scenario where although there was an increase in the rate change, the customer reduced its captive retention, i.e., bears more risk affected by the rate change in excess of his captive.

For the third ratio, the ratio premium, all further changes of the risk within the captive were indirectly measured. For example, if the customer increased its risk in the captive via an additional inclusion of risk, it would want to increase the captive premium in order to amend for the additional risk. In that case, positive correlated suggests that an increase in the captive premium – and hence an increase in the risk – would occur at the same time as an increase in the rate change.

Given that the blue and the orange bars only represent 30%, this indicates there was no clear positive correlation. Figure 5 & Figure 6.

If the approach outlined in the section “Hypothesis and how we tried to measure it” would really be taken by a majority of the customers, there would be a significant dominance of the blue bars, which would be approaching 100%.

Based on the internal statistics, there is no clear trend that would show that customers chose the outlined approach of flexible captive adjustment during the market cycles. Why is that not the case, is something holding them back? The next section will shed some light on that question.

Internal discussions

The buying behaviour of captive customers varies widely. Risk managers have different risk tolerances and preferences resulting in considerable differences in the way in which captive coverages are structured. Even when the same line of business is insured, one customer’s captive coverage will be structured totally differently to another. Our aim was to determine whether the onset of the hardening market or other factors would influence captive buying behaviour. However, given the variety of captive coverage structures being utilised, singular effects were difficult to pinpoint.

Conversations with experienced underwriters demonstrated a variety of reasons for such variation. First and foremost, the underlying nature of a customer’s business and the occurrence or lack of occurrence of claims influenced the choice of retention level and limit. Some customers had experienced heavy claims activity, especially if their current captive retention was set too low in the attritional layer. When claims leaked into the risk transfer layer, there was pressure to increase captive retentions and for the captive to take on more risk. There were not many instances of customers that had set their retentions too high which resulted in them bearing a high percentage of their losses and therefore seeking to reduce their retention. There was a general trend to increase captive retentions rather than to reduce, despite the market hardening only becoming a recent phenomenon. It was noticed that captives were rather reacting to adverse claims experience rather than acting more proactively in seeking to address changes in structure before they became required.

Francoise Carli, independent adviser at Zakubo Consulting and former risk manager of a major life science company, points out that it is always easier for captive owners to increase the captive exposure when the market conditions are difficult: when the risk premiums transferred to market are higher — with no real underlying reason relative to risk exposure or claims occurrence — it helps and pushes the mother company to increase its risk understanding and thus to invest in risk prevention and adjust significantly its exposure. The impact of external pressure on insurance costs, especially when everyone from the C-suite experiences it or can read it in the newspapers, is a much stronger argument than any of the risk analysis that can be provided. Once the change processes start, the assessment of the structure will be considered.

There were a number of reasons for keeping the captive structure stable or not changing too often. Long term agreements were in place for a number of larger customers, meaning that structures were only varied in exceptional circumstances offering stability for both the captive and insurer. Solvency and capital requirements were also listed as key considerations as to why a structure was set in a certain way. Increased capital requirements were often mentioned as a prominent reason preventing customers from assuming too high retentions. Perceived difficulty to agree changes with management was also cited as a reason.

Larger captive customers, with many lines of business, seemed to have better negotiating ability and buying power. There were also the obvious benefits associated with incorporating additional lines of business such as employee benefits or other traditional and non traditional non-life lines of business due to diversification effects. Larger captives were able to soften the impact of the need for increased retentions in the event of significant claims activity in the captive layer. Smaller captives were more likely to have less leeway to negotiate, but often were also more nimble and able to react more quickly.

Market survey

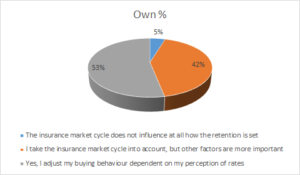

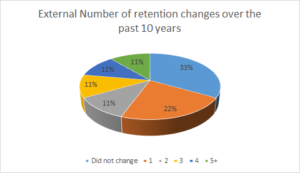

The results of the market survey presented an insight into captive buying behaviour. In a survey conducted of captive owners, risk managers, brokers and consultants, 33% of captive owners had not changed their coverage structure in the last 10 years (Figure 7). This was interesting, especially given a majority of participants interviewed were working in the industry for 10 years or more, and therefore had considerable experience.

A relatively large number (45% – Figure 7) had changed their structure at least once or twice, but the majority did retain the captive coverage structure in terms of the basic single occurrence and aggregate limit. It was recognized that there were many other levers that captive owners have at their disposal such as sublimits or exclusions, however the most common tool was the captive retention.

The survey also alluded to some surprising results. Almost all of the participants in the survey said that they use their captive in an efficient manner in the hardening market environment, however only 53% (Figure 8) of captive owners said that they do take the market cycle into account, and it was also described above that captive structures seem to remain largely unchanged. A reason for this may be because the hard market has not taken its full course and the impact has not been felt by captives as of yet, but it remains to be seen in the future whether captives will modify their structures.

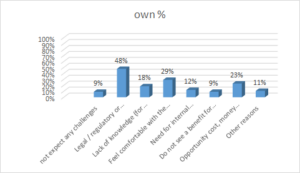

The reasons were provided for not changing the structure are shown in Figure 9. There seem to be barriers surrounding the legal and regulatory environment which are holding back captive owners. Captive advisers seconded this explanation, although opportunity cost was cited by advisors more often.

Holger Kraus, who leads the captive committee of the German risk and insurance managers´ association, added that a comprehensive analysis of the implications and effects of changes in a captive structure beforehand is very helpful to avoid any surprises. This involves aspects of the captive itself such as the expected additional losses and their volatility, the risk bearing capacity of the captive and the potential need for a capital increase due to a changed program structure as well as the implications of an increased retention for the parent company that consolidates the captive.

Looking to the future, change seems to be on the horizon. A large number of captive owners were considering changing their captive retention or coverage structure, especially due to the onset of the hardening market, although also for other reasons which may have been the lack of change previously.

Given the survey results, it is expected that there will be some increased activity in terms of captive structuring. It will be interesting to see what captive owners will do compared to with what their advisors will suggest. Larger restructurings such as moving from a gross to net cession or vice versa is also a preferred option for advisors. Advisors who are often in contact with insurers and fronting providers are often more aware of other services such as risk engineering which can be used to reduce the occurrence of claims via means of prevention.

Conclusion

Captive owners are able to reduce the total cost of risk by ensuring they actively managed their risk exposure. The starting hypothesis stated that Captive owners were comfortable in adjusting the risks bourn by Captives in accordance with the Insurance Cycle and regularly did so.

The internal analysis as well as the external survey, however, demonstrated that this was perhaps not the case. Captive owners seem reluctant to make frequent changes due to a number of reasons.

While this may have been acceptable in the past due to a soft market and abundance of capacity over an extended period of time, the question is – will the onset of a hardening market present an additional challenge requiring more frequent analysis and adjustment?

We would recommend captive managers, brokers and consultants to consider individual cases carefully and weight the benefits of adjusting the captive structure versus the potential challenges. Perhaps the addition of new lines of business could relieve strain where rates are rising with particular intensity. While still at the beginning of a hardening market, we believe that now is the right time to re-evaluate your captive retention and make active choice for a proper retention.

Strategic outlook

Latest European buying behaviour developments of captive owners indicate — especially for property lines — an increased level of reinsurance exposure towards their captives. Furthermore, the market complexity has increased due to the regulation driven development and market characteristics. A lot of captive owners consider to broaden the underwriting scope for their captives for instance for EB-Life exposure or for third party risks with the aim of strengthening the core business of the captive owner. In addition, captives will get used more as a strategic door opener in order to capture the opportunities in the reinsurance and ILS markets. This approach will most probably support the risk management and risk financing of constantly evolving and complex new risks like cyber.

As Francoise Carli points out, the current market conditions will change the buying behaviors and the various exposures of many captive owners. Even though it is always complex to drastically change programme structures in a captive, the last 18 months have shown all risk takers that the universe of risks they managed for years is changing. The pandemic risk is a good example here; while this risk is known and targeted in the top 10 global risks mentioned in the Global risk report of the World Economic Forum, it has obviously become much more important as of late. This is a fantastic opportunity for all risk managers to initiate a full review of their risks and adjust the captive exposure to better serve the future challenges of their mother company.

In this context, combined with the hardening of the market, it is likely that the determination of appropriate captive retention levels per line of business or as a multi-line protection will become more essential than in the past.